- KDDI HOME

- Corporate Information

- Investor Relations

- IR News

- 2022

- KDDI Issues Sustainability Bonds (KDDI Tsunagu Chikara Bonds)

KDDI Issues Sustainability Bonds (KDDI Tsunagu Chikara Bonds)

September 28,2022

KDDI Corporation

―About 100 billion yen in total to promote projects that help solve social issues and protect the global environment―

As KDDI created its Sustainability Finance Framework (the "Framework"), to deploy funds for projects that address social issues and protect the environment, the Company decided to issue KDDI Tsunagu Chikara Bonds (Unsecured straight bonds, the "Bonds") - KDDI's first sustainability bonds.

1. Background and Purpose of the Framework Development and Bonds Issuance

In May 2022, the KDDI Group unveiled its Mid-Term Management Strategy (FY2022-2024) [![]() 1] with the "KDDI VISION 2030" toward a resilient future society that balances economic development with solutions to social issues - while responding swiftly to changes in the business environment.

1] with the "KDDI VISION 2030" toward a resilient future society that balances economic development with solutions to social issues - while responding swiftly to changes in the business environment.

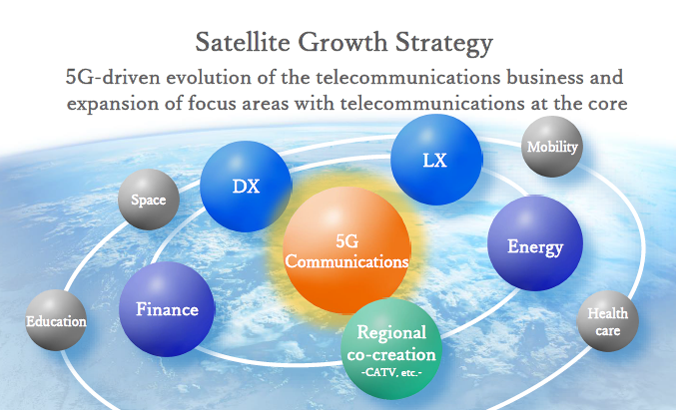

The Mid-term Management Strategy stresses "Sustainability Management," which aims for sustainable growth of society and the enhancement of corporate value together with our partners. It promotes its "Satellite Growth Strategy," based on evolution of our telecommunications business through 5G; business expansion in focused areas with telecommunications at its core; and the strengthening of our management's foundation to support this strategy.

KDDI has developed this framework to promote "Sustainability Management," the "Satellite Growth Strategy" and "Strengthening Management" from a fundraising perspective. We aim to achieve sustainable social growth and enhance our corporate value.

KDDI will contribute to the "Digital Garden City Nation Concept" proposed by the government by constructing 5G areas. In addition, the funds will be used for various projects, such as promoting energy conservation and the use of renewable energy in base stations and telecommunication facilities. We aim to achieve virtually zero CO2 emissions by FY2030.

As this represents the first financing based on this Framework, we have decided to issue about 100 billion yen in Bonds.

<KDDI's Sustainability Management>

<KDDI's Satellite Growth Strategy>

2. Outline of the Bonds

| Name | KDDI Corporation 30th Unsecured Bond (with inter-bond pari passu clause special clause) (Sustainability Bond) | KDDI Corporation 31st Unsecured Bond (with inter-bond pari passu clause special clause) (Sustainability Bond) |

|---|---|---|

| Term of issue | 3 years | 5 years |

| Total amount of issue (planned) | About 100 billion yen in total | |

| Publication Date | October 2022 (fastest) | |

| Structuring agent [ |

Daiwa Securities Co., Ltd. | |

| Lead managing underwriter | Daiwa Securities Co., Ltd.; Mitsubishi UFJ Morgan Stanley Securities Co., Ltd.; Mizuho Securities Co., Ltd.; Nomura Securities Co., Ltd. | |

3. Develop this framework and obtain an external evaluation

The Framework sets forth four core elements ((1) Use of Proceeds, (2) Project Evaluation and Selection Process, (3) Management of Proceeds, and (4) Reporting) based on the following principles and guidelines.

In addition, we have obtained a second opinion from Rating and Investment Information, Inc. (R&I) regarding the Framework's conformity with each of the aforementioned principles, etc.

4. Use of Proceeds

Funds raised under the Framework will be used for the following eligible projects consistent with the "Satellite Growth Strategy" and "Strengthening Management" as part of KDDI's efforts to promote sustainability management in its mid-term management strategy. Please refer to the Framework in detail.

The Bonds fall under the category of SDGs bonds, in which the funds raised are used for projects that contribute to solving environmental and social issues.

<SDGs bonds' logo>

![]() KDDI Sustainability Finance Framework (in Japanese only)

KDDI Sustainability Finance Framework (in Japanese only)