- KDDI HOME

- Corporate Information

- Investor Relations

- IR News

- 2020

- Agreement on New Business and Capital Alliance between Toyota Motor Corporation and KDDI Corporation

Agreement on New Business and Capital Alliance between Toyota Motor Corporation and KDDI Corporation

October 30,2020

- Toyota Motor Corporation

- KDDI Corporation

- Strengthening the Alliance for a Society in which Towns, Homes, People, and Cars Are All Connected -

Toyota Motor Corporation (Head Office: Toyota City, Aichi Prefecture; President: Akio Toyoda; hereinafter, "Toyota" ) and KDDI Corporation (Head Office: Chiyoda-ku, Tokyo; President: Makoto Takahashi; hereinafter, "KDDI") have agreed on a new business and capital alliance today with the purpose of further strengthening the relationship between the two companies. Details of the agreement are as follows:

■Background

Since KDDI's founding in October 2000 through the merger of Daini Denden Inc. (DDI), KDD Corporation, and IDO Corporation, Toyota has been KDDI's second largest shareholder (with 12.95% of shares held as of September 2020). Since 2002, Toyota and KDDI have cooperated on G-BOOK and other services for the telematics business of Toyota. In addition, prompted by the increase in internet-connected vehicles-connected cars-the two companies have been working together since 2016 to build a global communications platform, independent of existing roaming services, to ensure stable high-quality telecommunications around the globe between vehicle communications devices and cloud services. In this and other ways, the companies have been accelerating initiatives to provide safety and comfort through the integration of vehicles and telecommunications.

■Details of the Business Alliance

The companies are also accelerating new initiatives that go beyond the borders of their core business of mobility and telecommunications in anticipation of the coming future society in which towns, homes, people and cars are all connected.

The companies will continue working to develop services that enrich people's lives to solve social issues mainly through the use of big data, and to promote R&D in the areas of telecommunications and connected car technologies.

Specifically, the companies will continue promoting the following initiatives:

The Two Companies' Initiatives Going Forward

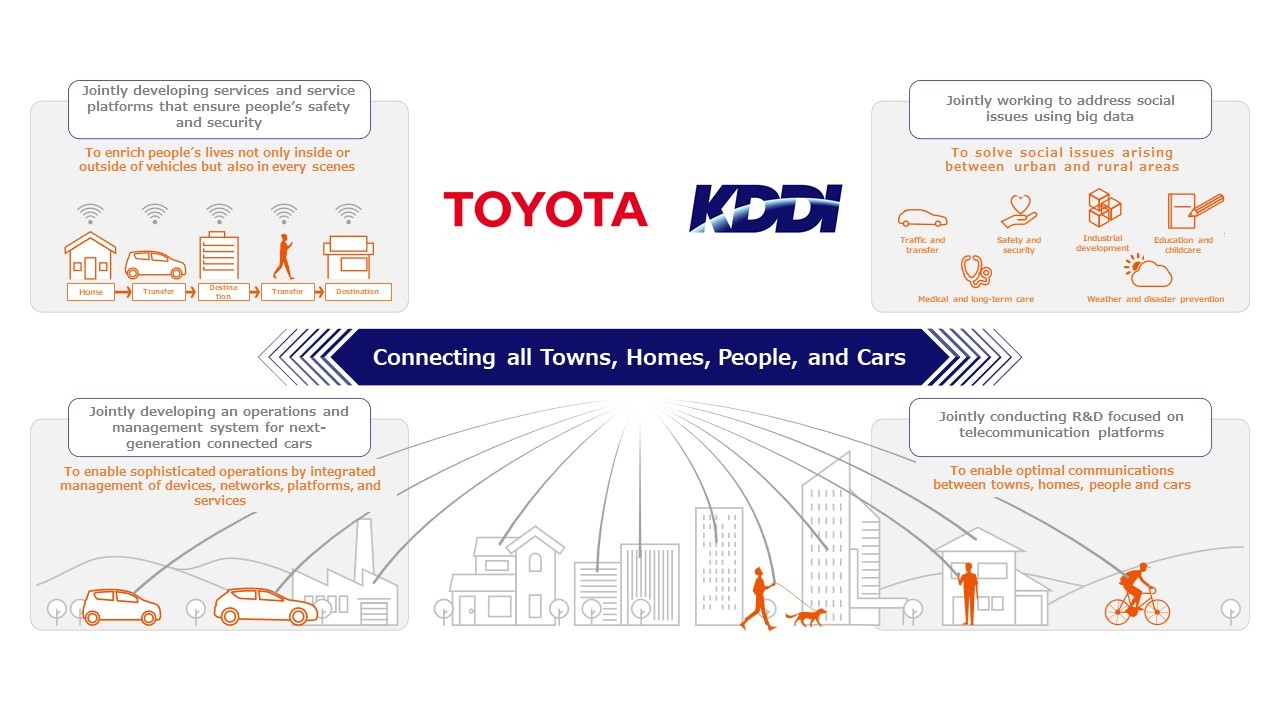

- Jointly conducting R&D focused on telecommunication platforms that enable optimal communications between towns, homes, people, and cars as communication technologies evolve, including 4G, 5G, and 6G

- Jointly developing an operations and management system for next-generation connected cars to enable sophisticated operations by integrated management of devices, networks, platforms, and services

- Jointly developing services and service platforms that aim to enrich people's lives and ensure their safety and security not only inside or outside of vehicles but also in every scenes

- Jointly working to address social issues arising between urban and rural areas and regional communities using big data about towns, homes, people, cars, and more

Details of the Capital Alliance

Against the backdrop of the aforementioned business alliance, both companies reached the conclusion that it will be necessary to further strengthen their capital ties to promote their strategic alliance over the medium and long terms. The companies agreed to the disposal of 18,301,600 shares of KDDI treasury stock [![]() 1] (totaling around 52.2 billion yen) through a third-party allocation with Toyota as the recipient.

1] (totaling around 52.2 billion yen) through a third-party allocation with Toyota as the recipient.

Therefore, Toyota is expected to hold 13.74% of KDDI's shares. The share acquisition date (payment deadline) is scheduled for January 29, 2021.

(Reference)

- Conceptual Diagram of the Business Alliance between the Two Companies

- Shareholding Ratios of KDDI Shares (as of September 30, 2020)

| Name | Number of shares held (stocks) | Shareholding ratio [ | |

|---|---|---|---|

| Shareholding ratio before the third-party allocation | Toyota Motor Corporation | 298,492,800 | 12.95 |

| Shareholding ratio after the third-party allocation | Toyota Motor Corporation | 316,794,400 | 13.74 |